Credit Balance

Invoicing

Disable if you are required by the law of your country not to issue invoices for Add Funds transactions. As soon as customers send the payment, the proforma will be removed from WHMCS without even turning into an invoice. This option is automatically turned on if taxation on Add Funds invoices are enabled.

Taxation

In many countries, every time you receive a payment you have to issue an invoice with VAT applied as normal. This doesn't happen in WHMCS when customers pay Add Funds invoices. Even though the resulting document is an invoice, it is VAT-free and this could be considered as tax evasion depending on the laws of some country.

When you enable this option Billing Extension charge taxes on Add Funds invoices. Let's suppose that your VAT rate is 20%. If your Tax Type is Exclusive 10 euro will turn into an invoice of 12 euro (10 + 2 VAT). On the other hand if it is Inclusive it will be adjusted to 8.33 + 1.67 VAT (10 euro total).

In both cases described above, your customer receives in his credit balance the VAT-free amount (10 euro when tax is Exclusive or 8.33 when it's Inclusive). This is necessary to avoid that customers pay VAT twice: one when they upload credit and the other when they apply this credit to pay other invoices. We encourage you to look into this matter in greater depth by reading tax calculation.

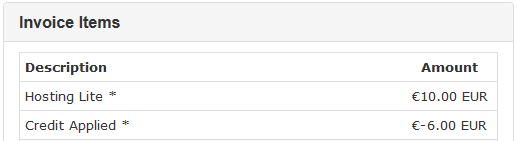

Displaying Credit Line

- Subtotal: 4 euro (subtotal - credit)

- 20% VAT: 0.80 euro (20% of 4 euro)

- Credit: 6 euro

- Total: 4.8 euro (subtotal + VAT)

This is how we can "explain" to WHMCS how taxes should be calculate. That said, you can freely decide if you want to show or hide this special line in HTML and PDF version of invoices. We recommend you to hide it since customers could find it a bit confusing.

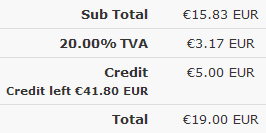

Balance Displaying on Invoices

Enable to display on invoices (HTML and PDF version) the credit left in the account of your customer at the moment the invoice in question has been paid. This amount is displayed right below Credit line.

Billing Extension 37

Billing Extension 37

Commission Manager 3

Commission Manager 3

Mercury 8

Mercury 8

Payments Bundle 2

Payments Bundle 2

Comments (0)